- Published on

Lego Investment Landscape: 2023 Year-End Insights and Trends

- Authors

- Name

- Bowtied FOB

- @bowtiedfob

Congratulations! You've discovered a unique corner of the internet. Whether you're new to LEGO investment or an experienced player in this field, you're in for a treat. Today, you'll either learn something new or gain valuable insights that could boost your ROI. Welcome to a world where LEGO isn't just a toy, but a smart investment choice.

Let's get straight to the point – it's all about the data here, no fluff. We're diving into the performance of LEGO sets that retired in 2022, analyzing their value as of year-end 2023. The premise of LEGO investment is straightforward: each set is produced in limited quantities, and LEGO retires hundreds of sets annually. This typically leads to a price increase post-retirement. December of the year following a set's retirement often marks an optimal point, striking a balance between holding duration and value appreciation.

Discussing price appreciation without considering volume is only half the story. Imagine selling a single set at a 1000% markup – impressive, right? But does it significantly impact your overall profit? That's where volume comes into play. For our study, we'll focus on Amazon, which boasts not only remarkable price appreciation but also substantial selling volume. We're using the average December prices on Amazon as our benchmark. Keep in mind, this doesn't imply that you can't fetch higher prices on platforms like eBay or Bricklink; it's just that Amazon provides a reliable baseline for our analysis.

Top performers and losers

Relative return over MSRP per set

To gauge the return on investment, we calculate the percentage return based on Amazon's average prices in December 2023, compared to the original Manufacturer's Suggested Retail Price (MSRP). This approach provides a clear and quantifiable measure of how much value each LEGO set has gained since its initial release.

Best performing sets

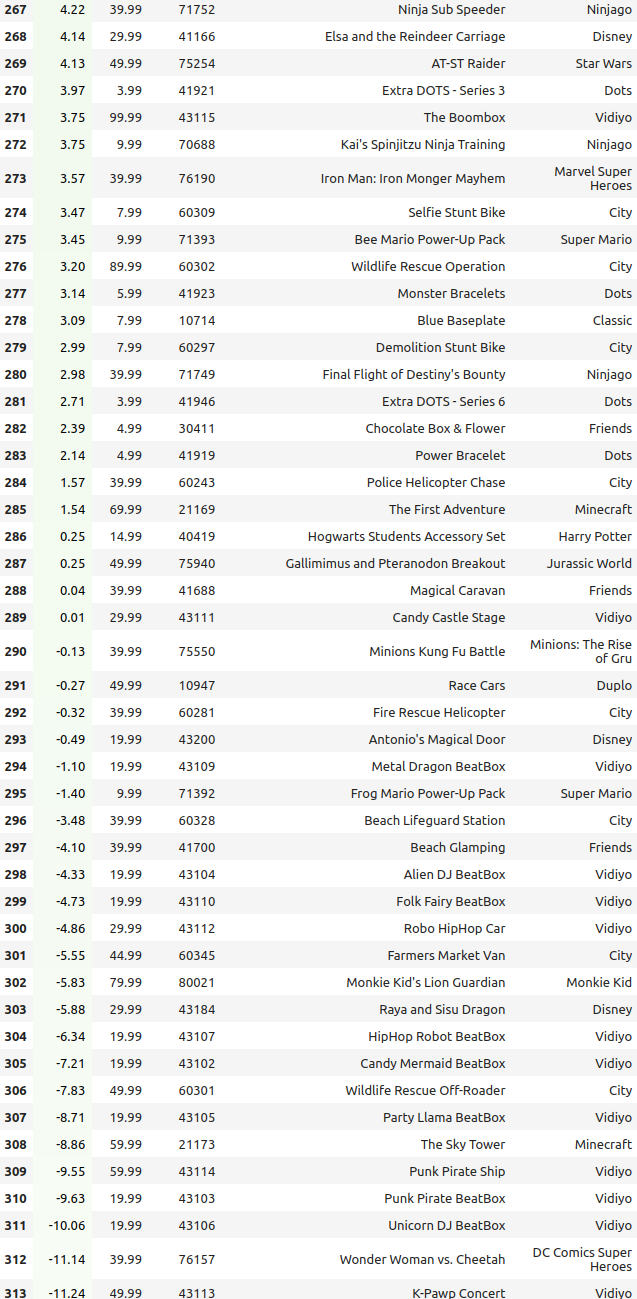

Worst performing sets

Dollar return over MSRP per set

An intriguing pattern emerges when we examine the relative returns: sets with lower initial prices often exhibit remarkable appreciation rates. However, considering that there’s usually a cap on the number of sets one can purchase, the absolute dollar return becomes a critical factor. It's not just about the percentage increase; it's about the actual profit in dollars that an investor can realize. This insight underscores the importance of balancing the allure of high percentage gains with the practicality of substantial dollar returns.

Best performing sets

Worst performing sets

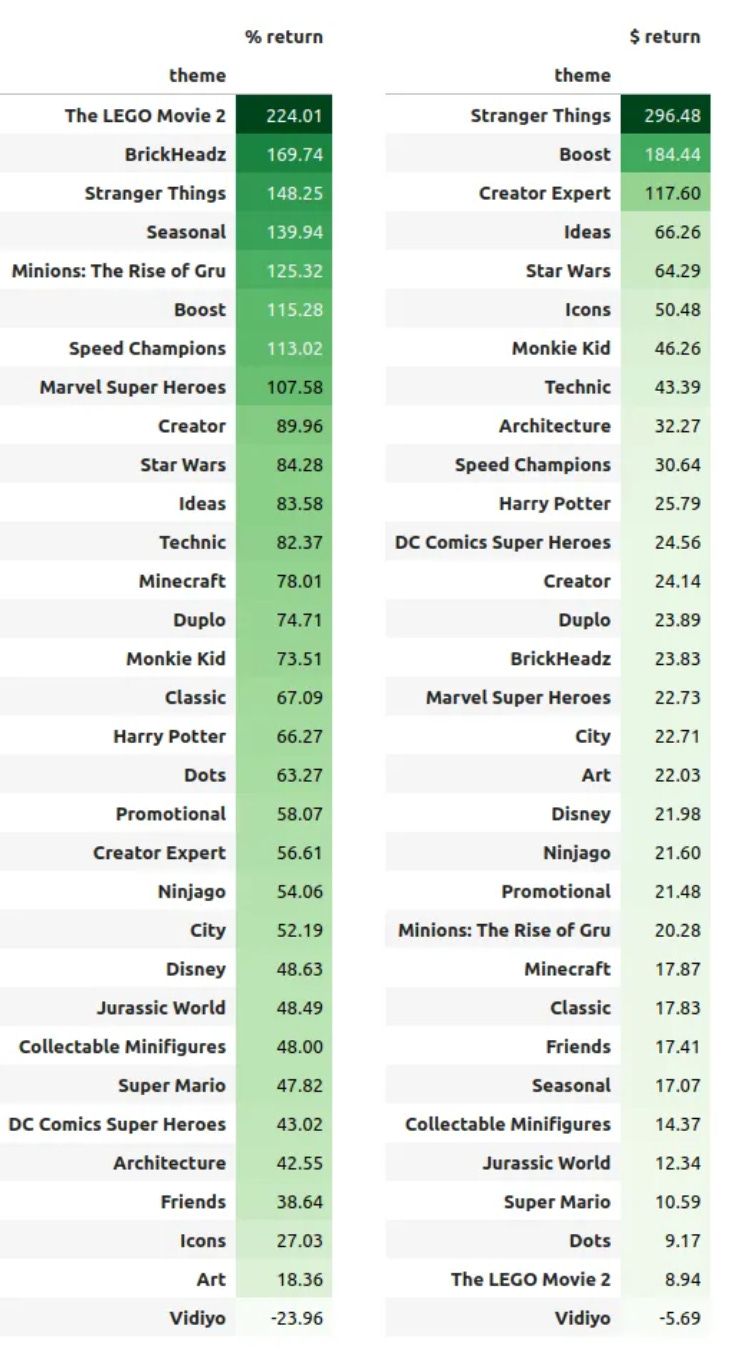

Per theme performance

We've organized our return analysis by theme, presenting relative returns on the left and absolute dollar returns on the right, offering a clear, dual-perspective view on investment performance.

Some observations

While our post primarily offers a holistic view of the market's overall performance, a quick glance at the data immediately highlights some standout 'alphas'.

Helmet fever

The TIE fighter Pilot helmet (75274) retired in January, 2022, so comparing to other sets, it has longer time for appreciation. But in general, all helmet collections perform very well.

Low ticket items

For investors on a budget who don't mind the extra effort, low-cost items offer the potential for impressive returns. Take the BrickHeadz theme, for instance – it consistently performs well. Although the absolute dollar returns might seem modest, they can be quite substantial when you accumulate a larger volume.

High ticket items

For investors with deeper pockets, high-ticket items are an attractive option. These generally face less competition and are less impacted by purchase limits. A prime example is the Creator Expert theme, which stands out as a solid choice for those looking to invest in higher-value sets.

Vanilla strategy performance

Let's run a backtest of straightforward investment strategies on these data. Factoring in a reasonable 20% discount on MSRP and a 35% selling cost (covering Amazon seller fees, shipping, etc.), we'll explore the effectiveness of various simple approaches.

Randomly buy 100 sets, 20 each

Total cost: 18599.30, ROI: 26%

Buy all sets, 20 each

Total cost: 63505.02, ROI: 24%

Our model performance [Redacted]

Comparing with investment benchmark

S&P 500 (2022, 2023) ROI: 0.08%

Conclusion

- investing in LEGO sets presents a uniquely low-risk opportunity – a rarity in the investment landscape. It's a realm where losses are uncommon, offering a level of assurance seldom found elsewhere.

- However, not all themes are created equal. There are certain ones you'll want to steer clear of to maximize your returns.

- Remember, a well-rounded investment strategy should consider both relative and absolute returns. Balancing these two perspectives is crucial for building a profitable LEGO investment portfolio.

Disclaimer: The contents of this article are not intended to be considered as legal or financial advice. The perspectives shared here are purely opinions from seasoned LEGO investors with backgrounds in quantitative trading and machine learning experts from major tech companies. This information is provided for educational and informational purposes only.